The wafer foundry mature process chip field is facing new challenges

Driven by the Internet of Things, artificial intelligence and other fields, the momentum of wafer foundry advanced process is booming, semiconductor manufacturers such as TSMC, Samsung and Intel have accelerated the layout, but the competition of mature process chips has not stopped...

Christophe Fouquet, the new CEO of Dutch semiconductor equipment manufacturer ASML, recently said that the world needs traditional process chips produced in China.

According to the report, Fouquet said that the auto industry, especially the German auto industry, needs the traditional process chips that Chinese chip makers are currently investing in.

It is ASML's second largest market in the world

Executives are optimistic about the development of China's semiconductor industry

As the world's largest lithographic machine manufacturer, ASML has been developing together with the Chinese semiconductor industry since it entered the Chinese market in 1988. After more than 30 years of development, China has become one of the top three markets for ASML in the world.

According to ASML's previously published annual report, net sales in 2023 reached 27.6 billion euros, an increase of 30%. Among them, the Chinese market accounted for 29% of ASML's lithography system sales, more than 6.4 billion euros, making it the second largest market for ASML.

Previously, ASML has repeatedly stressed the importance of the Chinese market to the global semiconductor industry. Recently, two ASML ceos have again expressed similar views.

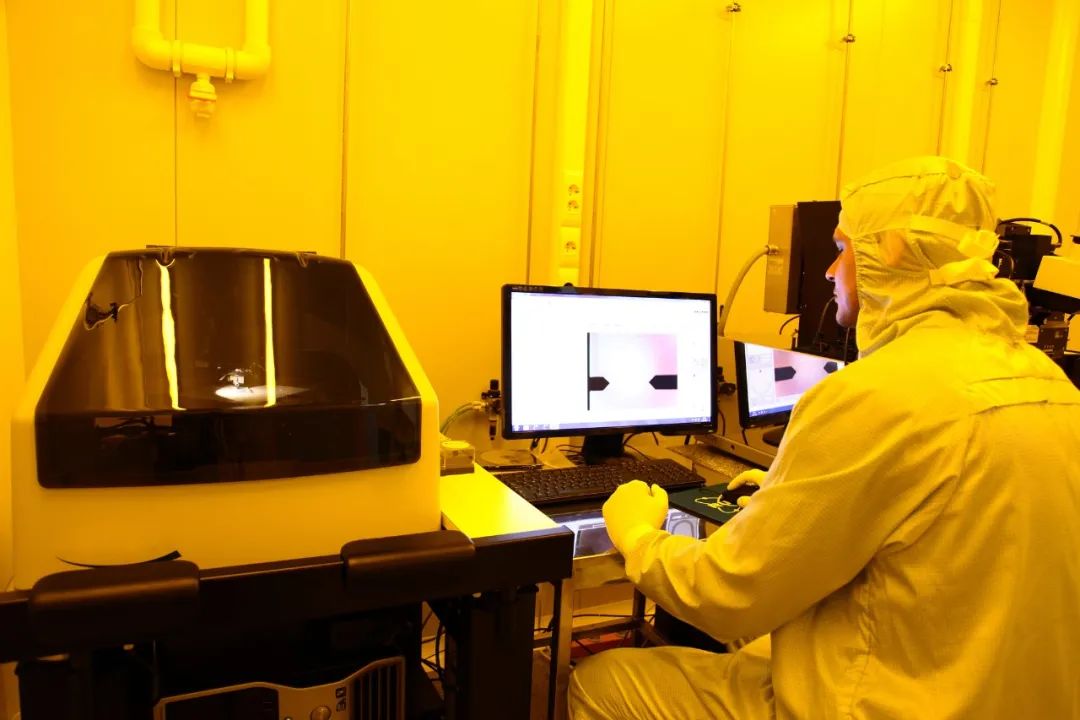

Picture source:Paixin

According to the German "Handelsblatt" reported on July 9, in April this year, the current CEO of ASmer Christophe Fukai said in an interview with the media that the current automotive industry, especially the German automotive industry, is in urgent need of a large number of chips made by Chinese chip manufacturers using mature technology.

According to Dutch radio BNR, Peter Wennink, former CEO of ASML, said that ASML has customers and employees in China for more than 30 years, and they have been contributing to the development of ASML's business, so the company "also has obligations (to them)."

Wennink said earlier that China, as an important player in the semiconductor industry, is a very important supplier to the global market, and said that the world cannot ignore "the importance of China's semiconductor production capacity to the global electronics industry."

In addition, ASML global senior vice president and President of China Bo Shen also said during the Shanghai CIIE held in November last year that Chinese local brands have occupied a considerable share in the important semiconductor end market areas such as consumer electronics, personal computers and servers, electric vehicles, and new energy, which has laid the foundation for the sustainable development of China's mature process market.

Shen Bo said that in the future, ASML will continue to support the development of customers in China under the premise of complying with relevant laws and regulations, and help customers achieve cost reduction and efficiency increase in the mature process chip manufacturing process.

Smic, Huahong, Jinghe and other mature production process

In 2027, China's production capacity will account for 39% of the world's total

The so-called "traditional process chip", also known as mature process chip, refers to the use of mature but still developing manufacturing processes to produce chips, mainly refers to 28nm and above chips, widely used in consumer electronics, automobiles, home appliances and defense industry and other fields.

As the world's largest market for mature process chips, China plays an important role in the highly globalized semiconductor industry. Fu Kai said that at present, the Chinese government's strong support for the semiconductor industry and the growth of the terminal market have injected a steady stream of impetus for the sustainable development of the Chinese semiconductor market, especially the development of the mature process market.

Picture source:Paixin

2023~2027, the global foundry mature process (28nm and above) and advanced process (16nm and below) capacity ratio of about 7:3. Driven by the process of localization of the semiconductor industry, mainland Chinese manufacturers represented by SMIC, HuaHong Group, and Hefei Nexchip are actively expanding mature process production capacity.

According to a report released by TrendForce Research Institute, a global market research organization, in October last year, China is the most active in expanding production due to its policies and subsidies aimed at promoting local production, and the proportion of mature process capacity is expected to grow from 29% in 2023 to 33% in 2027.

Additionally, in a research report released in June this year, TrendForce stated that there will be a significant amount of new capacity for foundry services released globally by 2025, such as TSMC JASM, PSMC P5, SMIC's new factories in Beijing and Shanghai, HHGrace Fab9, HLMC Fab10, and Nexchip's N1A3, and it is expected that competition in mature processes will remain relatively fierce.

Cover picture source:Paixin